The 401(k) plan is a retirement savings plan that is sponsored by an employer. It allows employees to contribute a portion of their pre-tax income to a retirement account. The importance of a 401(k) plan lies in its ability to provide a source of income during retirement years. The amount contributed is not subject to income tax until it is withdrawn from the account. This can be a great way to save for retirement, as the contributions are deducted automatically from the employee’s paycheck, making it easy to save without even thinking about it.

The term “401(k)” comes from the section of the Internal Revenue Code that established these types of retirement savings plans. The section is 401, and the subsection is k. The 401(k) plan was created in 1978 as a way for employees to save for retirement on a tax-advantaged basis. It has since become one of the most popular retirement savings plans in the United States.

Why is 401(k) plan is important?

Tax Benefits

Contributions made to a 401(k) plan are typically made on a pre-tax basis, which means that the contributions are deducted from an employee’s taxable income. This can help to reduce the amount of taxes owed in the current tax year.

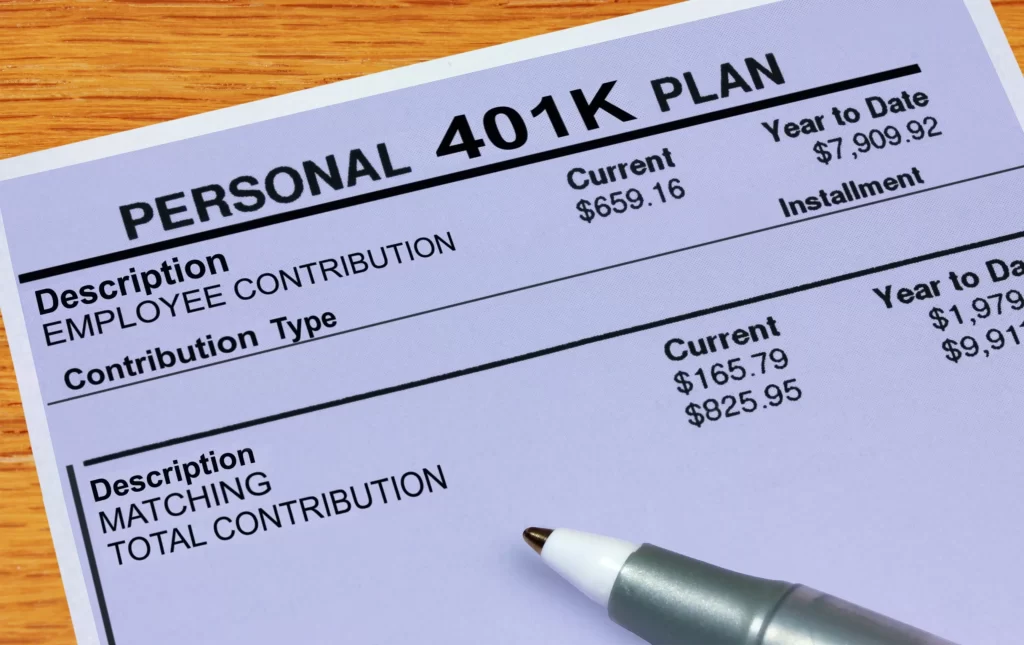

Employer Matching

Many employers offer a matching contribution to employee 401(k) contributions. This means that the employer will match a certain percentage of the employee’s contributions, up to a certain amount. This can help to boost retirement savings and provide additional funds for retirement.

Investment Options

401(k) plans typically offer a range of investment options, including mutual funds, index funds, and individual stocks. This allows employees to choose investments that match their individual risk tolerance and investment goals.

Portability

If an employee changes jobs, they can typically take their 401(k) plan with them. This makes it easy to continue saving for retirement, even if an employee moves to a different company.

Retirement Income

The primary purpose of a 401(k) plan is to provide a source of income during retirement. By contributing to a 401(k) plan throughout their working years, employees can build a nest egg that can provide a steady stream of income during retirement.

Contribution Limits

401(k) plans have higher contribution limits than other retirement savings plans, such as IRAs. This allows employees to save more money for retirement each year.

Types of 401 (k) Plans

Traditional 401(k) Plan

The traditional 401(k) plan is the most common type of 401(k) plan. In this plan, employees can contribute up to $19,500 per year in 2021, or $26,000 per year if they are 50 or older. Employers may also choose to match a portion of the employee’s contributions, up to a certain percentage of the employee’s salary. The contributions and earnings in the account are tax-deferred until they are withdrawn from the account.

Safe Harbor 401(k) Plan

A safe harbor 401(k) plan is similar to a traditional 401(k) plan, but with a few key differences. In this plan, employers are required to make either a matching contribution or a non-elective contribution to the plan on behalf of all eligible employees. This ensures that the plan is compliant with IRS regulations regarding 401(k) plans. In exchange for making these contributions, the plan is exempt from certain annual testing requirements that apply to traditional 401(k) plans.

Solo 401(k) Plan

A solo 401(k) plan is designed for self-employed individuals or business owners who have no employees other than themselves and their spouses. In this plan, the individual can contribute both as an employer and an employee, allowing for higher contribution limits than a traditional 401(k) plan. For 2021, the individual can contribute up to $58,000 per year, or $64,500 if they are 50 or older.

Roth 401(k) Plan

A Roth 401(k) plan is similar to a traditional 401(k) plan, but with one key difference: contributions are made on an after-tax basis, meaning that the contributions are subject to income tax in the year they are made. However, the contributions and earnings in the account grow tax-free, and withdrawals are also tax-free if they are made after age 59 1/2 and the account has been open for at least five years.

Automatic Enrollment 401(k) Plan

An automatic enrollment 401(k) plan is designed to encourage employees to save for retirement by automatically enrolling them in the plan when they are hired. Employees can choose to opt out of the plan, but studies have shown that employees are more likely to save for retirement when they are automatically enrolled in a plan. Employers can also choose to automatically increase the employee’s contribution rate over time, further encouraging savings.

It is important to carefully consider the options and choose the plan that best meets the needs of the employer and the employees.

Frequently Asked Questions about 401(k) Plan

Does 401(k) plan have minimum requirement?

Yes, the 401(k) plan does have a minimum requirement. The minimum requirements are set by the IRS and are designed to ensure that the plan does not favor highly compensated employees over other employees. One of the requirements is that the plan must cover a certain percentage of the employees who are eligible to participate in the plan. Additionally, the plan must provide benefits that are not discriminatory and must comply with various other IRS regulations.

There is also a minimum contribution requirement for the 401(k) plan. Employers are required to contribute a certain amount of money to the plan each year, although the amount varies depending on the type of plan and the size of the company. Employers are also required to offer employees the opportunity to contribute to the plan, although employees are not required to do so. The minimum contribution requirement helps ensure that employees have the opportunity to save for retirement and that the plan is not used solely to benefit highly compensated employees.

Does 401(k) plan pay dividends?

In general, 401(k) plans do not pay dividends directly to participants. However, if the plan invests in dividend-paying stocks or mutual funds, those dividends are reinvested in the plan and can potentially increase the value of the participant’s account over time. Some 401(k) plans also offer the option for participants to receive dividend payments in cash instead of reinvesting them, but this is not a common feature. It is important to review the plan documents and investment options offered by your specific 401(k) plan to understand how dividends are handled.

How does it work when I change a Job?

When you change jobs, you may face a decision about what to do with your 401(k) plan. You have a few options to consider:

- Leave the money in the plan: If your plan allows it, you may choose to leave your retirement savings in your old employer’s 401(k) plan. This may be a good option if you are happy with the plan’s investment options and fees, and if you don’t mind keeping track of multiple retirement accounts.

- Roll the money into your new employer’s plan: If your new employer offers a 401(k) plan, you may be able to transfer your old 401(k) savings into the new plan. This may simplify your retirement planning by consolidating your savings into one account. However, be sure to compare the investment options and fees of your old and new plans to make sure the new plan is a good fit for you.

- Roll the money into an IRA: You can also choose to roll over your 401(k) savings into an individual retirement account (IRA). This may give you more control over your investments and may offer lower fees than a 401(k) plan. Additionally, an IRA may offer more investment options than a 401(k) plan.

- Cash out: You can choose to cash out your 401(k) plan when changing jobs, but this is generally not recommended. If you cash out, you’ll owe income tax on the withdrawal, and if you’re under age 59 1/2, you’ll also owe a 10% early withdrawal penalty. Additionally, you’ll lose out on the potential for tax-deferred growth and compounding that comes with leaving your savings invested.

You must carefully consider your options and their potential consequences before making a decision about what to do with your 401(k) plan when changing jobs.